-

Notifications

You must be signed in to change notification settings - Fork 2

AVQ

The AVQ (Alpha Vantage Queries) function group returns stock data from the Alpha Vantage (AV) provider.

Alpha Vantage provides a free API for realtime and historical data on stocks and other finance data in JSON or CSV formats. AVQ is a wrapper to get these data via a Excel user-defined function to Excel. AVQ currently supports the following Alpha Vantage APIs:

-

GLOBAL_QUOTE: Returns the latest price and volume information.

See Excel Function QAVQ.

-

TIME_SERIES_INTRADAY: Intraday time series (open, high, low, close, volume).

See Excel Function QAVID.

-

TIME_SERIES_DAILY: Daily time series (daily open, daily high, daily low, daily close, daily volume).

See Excel Function QAVD.

-

TIME_SERIES_DAILY_ADJUSTED: Daily time series (daily open, daily high, daily low, daily close, daily volume, daily adjusted close, and split/dividend).

See Excel Function QAVDA.

-

TIME_SERIES_WEEKLY: Weekly time series (last trading day of each week, weekly open, weekly high, weekly low, weekly close, weekly volume).

See Excel Function QAVW.

-

TIME_SERIES_WEEKLY_ADJUSTED: Weekly adjusted time series (last trading day of each week, weekly open, weekly high, weekly low, weekly close, weekly adjusted close, weekly volume, weekly dividend).

See Excel Function QAVWA.

-

TIME_SERIES_MONTHLY: Monthly time series (last trading day of each month, monthly open, monthly high, monthly low, monthly close, monthly volume).

See Excel Function QAVM.

-

TIME_SERIES_MONTHLY_ADJUSTED: Monthly adjusted time series (last trading day of each month, monthly open, monthly high, monthly low, monthly close, monthly adjusted close, monthly volume, monthly dividend).

See Excel Function QAVMA.

Examples:

- =QAVQ("MSFT")

- =QAVID("MSFT", "volume")

- =QAVD("MSFT","volume",,"2019-12-27")

Note: AVQ requires a free Alpha Vantage API Key, that can be requested on www.alphavantage.co (only e-mail is required). The free API service is limited up to 5 API requests per minute and 500 requests per day. Buy a premium API key which provides a higher API call volume.

AVQ is an independent development and has no relationship to Alpha Vantage. In general, the same Alpha Vantage term of services apply.

The QAVQ function uses the Alpha Vantage GLOBAL_QUOTE API to return the latest price and volume information for the given stock symbol.

| Excel Formula | Result |

|---|---|

| =QAVQ("MSFT") | Returns the latest price of Microsoft Corporation. |

| =QAVQ("MSFT","volume") | Returns the latest volume of Microsoft Corporation. |

Syntax

QAVQ(symbol,[info])

| Argument Name | Description |

|---|---|

| symbol (required) | The symbol of the stock. The symbol can be a string, or a cell reference like A2. |

| info (optional) | The stock info to return. Supported values are open, high, low, price, volume, latest trading day, previous close, change and change percent (case insensitive). Default is price. |

Examples

The QAVID function uses the Alpha Vantage TIME_SERIES_INTRADAY API to return realtime or historical stock data for the given stock symbol.

| Excel Formula | Result |

|---|---|

| =QAVID("MSFT") | Returns the latest "close" stock quote of Microsoft Corporation. |

| =QAVID("MSFT","volume") | Returns the latest trading volume of Microsoft Corporation. |

| =QAVID("MSFT",,4,"15min") | Returns the 4th "close" stock quote of Microsoft Corporation based on a 15 minutes interval. Hint: Should be the stock quote that was valid for 45 minutes ago. |

| =QAVID("MSFT",,2,"60min") | Returns the 2nd "close" stock quote of Microsoft Corporation based on a 60 minutes interval. Hint: Should be the stock quote that was valid for 60 minutes ago. |

| =QAVID("MSFT",,101,,"full") | Returns the 101st "close" stock quote of Microsoft Corporation from the Alpha Vantage query result based on a 5 minutes interval. |

Syntax

QAVID(symbol,[info],[data_point_index],[interval],[output_size])

| Argument Name | Description |

|---|---|

| symbol (required) | The symbol of the stock. The symbol can be a string, or a cell reference like A2. |

| info (optional) | The stock info to return. Supported values are open, high, low, close and volume (case insensitive). Default is close. |

| data_point_index (optional) | The index (zero-based) of the time series data point. Default is 0. |

| interval (optional) | The time interval between two data points. Valid values are 1min, 5min, 15mn, 30min and 60min. Default is 5min. |

| output_size (optional) | The output size of the returned data points. Valid values are compact or full (case insensitive). Default is compact. |

Examples

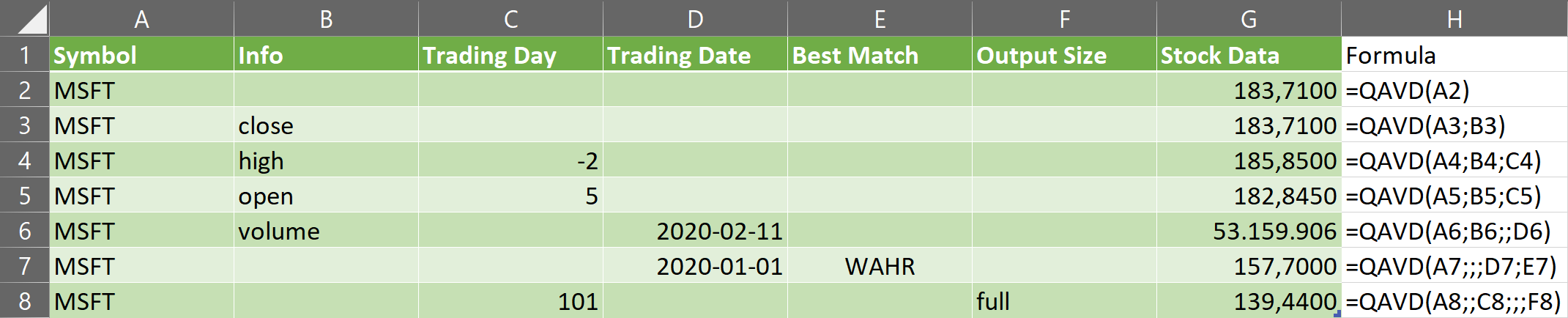

The QAVD function uses the Alpha Vantage TIME_SERIES_DAILY API to return daily stock data for the given stock symbol.

| Excel Formula | Result |

|---|---|

| =QAVD("MSFT") | Returns the recent "close" stock quote of Microsoft Corporation. |

| =QAVD("MSFT","close") | Returns the recent "close" stock quote of Microsoft Corporation. |

| =QAVD("MSFT","high",-2) | Returns the "high" stock quote of Microsoft Corporation from two days ago. |

| =QAVD("MSFT","open",5) | Returns the 5th "open" stock quote from the Alpha Vantage query result of Microsoft Corporation. |

| =QAVD("MSFT","volume",,"2019-12-27") | Returns the trading volume of Microsoft Corporation of 2019-12-27. Note: The given trading date must be contained in the AV response. |

| =QAVD("MSFT",,,"2020-01-01",TRUE) | Returns the "close" stock quote of Microsoft Corporation of 2019-12-31. Hint: No new year's day stock quote is available, latest available stock quote is then 2019-12-31 (best_match = TRUE). |

| =QAVD("MSFT","close",101,,,"full") | Returns the 101st "close" stock quote from the Alpha Vantage query result of Microsoft Corporation. |

Syntax

QAVD(symbol,[info],[trading_day],[trading_date],[best_match],[output_size])

| Argument Name | Description |

|---|---|

| symbol (required) | The symbol of the stock. The symbol can be a string, or a cell reference like A2. |

| info (optional) | The stock info to return. Supported values are open, high, low, close and volume (case insensitive). Default is close. |

| trading_day (optional) | Day/X-th item of the time series. If trading_day = 0 then most recent data point is selected (Date unspecific). If trading_day < 0 then data point of current date minus trading_day is selected (Date specific). If trading_day > 0 then the x-th (x = day) data point is selected (Date unspecific). Default is 0. |

| trading_date (optional) | The trading date. Note: The compact output size of the API returns only the last 100 data points/trading days. If the trading date is given, then it overrules the trading day argument. No default value. |

| best_match (optional) | Finds best trading data point, if no trading (day/date) argument matches. Valid values are FALSE (= 0) or TRUE (<> 0). Default is FALSE. |

| output_size (optional) | The output size of the returned data points. Valid values are compact or full (case insensitive). Default is compact. |

Examples

The QAVDA function uses the Alpha Vantage TIME_SERIES_DAILY_ADJUSTED API to return daily adjusted stock data for the given stock symbol.

| Excel Formula | Result |

|---|---|

| =QAVDA("MSFT") | Returns the recent "adjusted close" stock quote of Microsoft Corporation. |

| =QAVDA("MSFT","close") | Returns the recent "close" stock quote of Microsoft Corporation. |

| =QAVDA("MSFT","high",-2) | Returns the "high" stock quote of Microsoft Corporation from two days ago. |

| =QAVDA("MSFT","open",5) | Returns the 5th "open" stock quote from the Alpha Vantage query result of Microsoft Corporation. |

| =QAVDA("MSFT","volume",,"2019-12-27") | Returns the trading volume of Microsoft Corporation of 2019-12-27. Note: The given trading date must be contained in the AV response. |

| =QAVDA("MSFT",,,"2020-01-01",TRUE) | Returns the "adjusted close" stock quote of Microsoft Corporation of 2019-12-31. Hint: No new year's day stock quote is available, latest available stock quote is then 2019-12-31 (best_match = TRUE). |

| =QAVDA("MSFT","close",101,,,"full") | Returns the 101st "close" stock quote from the Alpha Vantage query result of Microsoft Corporation. |

Syntax

QAVDA(symbol,[info],[trading_day],[trading_date],[best_match],[output_size])

| Argument Name | Description |

|---|---|

| symbol (required) | The symbol of the stock. The symbol can be a string, or a cell reference like A2. |

| info (optional) | The stock info to return. Supported values are open, high, low, close, adjusted close, volume, dividend amount and split coefficient (case insensitive). Default is adjusted close. |

| trading_day (optional) | Day/X-th item of the time series. If trading_day = 0 then most recent data point is selected (Date unspecific). If trading_day < 0 then data point of current date minus trading_day is selected (Date specific). If trading_day > 0 then the x-th (x = day) data point is selected (Date unspecific). Default is 0. |

| trading_date (optional) | The trading date. Note: The compact output size of the API returns only the last 100 data points/trading days. If the trading date is given, then it overrules the trading day argument. No default value. |

| best_match (optional) | Finds best trading data point, if no trading (day/date) argument matches. Valid values are FALSE (= 0) or TRUE (<> 0). Default is FALSE. |

| output_size (optional) | The output size of the returned data points. Valid values are compact or full (case insensitive). Default is compact. |

Examples

The QAVW function uses the Alpha Vantage TIME_SERIES_WEEKLY API to return weekly stock data for the given stock symbol. The latest data point is the prices and volume information for the week (or partial week) that contains the current trading day. All other data points contain weekly stock information from last trading day of the week (usually of Friday).

| Excel Formula | Result |

|---|---|

| =QAVW("MSFT") | Returns the recent "close" stock quote of Microsoft Corporation. |

| =QAVW("MSFT","close") | Returns the recent "close" stock quote of Microsoft Corporation. |

| =QAVW("MSFT","high",-2) | Returns the "high" stock quote of Microsoft Corporation from two weeks ago. Hint: Trading date is calculated by subtraction trading week (in weeks) from the current date. The calculated trading date must be contained in the AV response. |

| =QAVW("MSFT","open",5) | Returns the 5th "open" stock quote from the Alpha Vantage query result of Microsoft Corporation. |

| =QAVW("MSFT","volume",,"2020-01-03") | Returns the trading volume of Microsoft Corporation of 2020-01-03. Note: The given trading date must be contained in the AV response. |

| =QAVW("MSFT",,,"2020-01-01",TRUE) | Returns the "close" stock quote of Microsoft Corporation of 2019-12-27. Hint: No new year's day stock quote is available, latest available stock quote is then 2019-12-27 (best_match = TRUE). |

Syntax

QAVW(symbol,[info],[trading_week],[trading_date],[best_match])

| Argument Name | Description |

|---|---|

| symbol (required) | The symbol of the stock. The symbol can be a string, or a cell reference like A2. |

| info (optional) | The stock info to return. Supported values are open, high, low, close and volume (case insensitive). Default is close. |

| trading_week (optional) | Week/X-th item of the time series. If trading_week = 0 then most recent data point is selected (Date unspecific). If trading_week < 0 then data point of current date minus trading_week is selected (Date specific). If trading_week > 0 then the x-th (x = week) data point is selected (Date unspecific). Default is 0. |

| trading_date (optional) | The trading date. If the trading date is given, then it overrules the trading week argument. No default value. |

| best_match (optional) | Finds best trading data point, if no trading (week/date) argument matches. Valid values are FALSE (= 0) or TRUE (<> 0). Default is FALSE. |

Examples

The QAVWA function uses the Alpha Vantage TIME_SERIES_WEEKLY_ADJUSTED API to return weekly adjusted stock data for the given stock symbol. The latest data point is the prices and volume information for the week (or partial week) that contains the current trading day. All other data points contain weekly stock information from last trading day of the week (usually of Friday).

| Excel Formula | Result |

|---|---|

| =QAVWA("MSFT") | Returns the recent "adjusted close" stock quote of Microsoft Corporation. |

| =QAVWA("MSFT","close") | Returns the recent "close" stock quote of Microsoft Corporation. |

| =QAVWA("MSFT","high",-2) | Returns the "high" stock quote of Microsoft Corporation from two weeks ago. Hint: Trading date is calculated by subtraction trading week (in weeks) from the current date. The calculated trading date must be contained in the AV response. |

| =QAVWA("MSFT","open",5) | Returns the 5th "open" stock quote from the Alpha Vantage query result of Microsoft Corporation. |

| =QAVWA("MSFT","volume",,"2020-01-03") | Returns the trading volume of Microsoft Corporation of 2020-01-03. Note: The given trading date must be contained in the AV response. |

| =QAVWA("MSFT",,,"2020-01-01",TRUE) | Returns the "close" stock quote of Microsoft Corporation of 2019-12-27. Hint: No new year's day stock quote is available, latest available stock quote is then 2019-12-27 (best_match = TRUE). |

Syntax

QAVWA(symbol,[info],[trading_week],[trading_date],[best_match])

| Argument Name | Description |

|---|---|

| symbol (required) | The symbol of the stock. The symbol can be a string, or a cell reference like A2. |

| info (optional) | The stock info to return. Supported values are open, high, low, close, adjusted close, volume and dividend amount (case insensitive). Default is adjusted close. |

| trading_week (optional) | Week/X-th item of the time series. If trading_week = 0 then most recent data point is selected (Date unspecific). If trading_week < 0 then data point of current date minus trading_week is selected (Date specific). If trading_week > 0 then the x-th (x = week) data point is selected (Date unspecific). Default is 0. |

| trading_date (optional) | The trading date. If the trading date is given, then it overrules the trading week argument. No default value. |

| best_match (optional) | Finds best trading data point, if no trading (week/date) argument matches. Valid values are FALSE (= 0) or TRUE (<> 0). Default is FALSE. |

Examples

The QAVM function uses the Alpha Vantage TIME_SERIES_MONTHLY API to return monthly stock data for the given stock symbol. The latest data point is the prices and volume information for the month (or partial month) that contains the current trading day. All other data points contain monthly stock information from the last trading day of the month (usually the last working day of the month).

| Excel Formula | Result |

|---|---|

| =QAVM("MSFT") | Returns the recent "close" stock quote of Microsoft Corporation. |

| =QAVM("MSFT","close") | Returns the recent "close" stock quote of Microsoft Corporation. |

| =QAVM("MSFT","high",-2) | Returns the "high" stock quote of Microsoft Corporation from two months ago. Hint: Trading date is calculated by subtraction trading month (in months) from the current date. The calculated trading date must be contained in the AV response. |

| =QAVM("MSFT","open",5) | Returns the 5th "open" stock quote from the Alpha Vantage query result of Microsoft Corporation. |

| =QAVM("MSFT","volume",,"2020-01-31") | Returns the trading volume of Microsoft Corporation of 2020-01-31. Note: The given date must be contained in the AV response. |

| =QAVM("MSFT",,,"2019-09-30",TRUE) | Returns the "close" stock quote of Microsoft Corporation of 2019-09-29. Hint: No stock quote is available on weekends, latest available stock quote is then 2019-12-29 (best_match = TRUE). |

Syntax

QAVM(symbol,[info],[trading_month],[trading_date],[best_match])

| Argument Name | Description |

|---|---|

| symbol (required) | The symbol of the stock. The symbol can be a string, or a cell reference like A2. |

| info (optional) | The stock info to return. Supported values are open, high, low, close and volume (case insensitive). Default is close. |

| trading_month (optional) | Month/X-th item of the time series. If trading_month = 0 then most recent data point is selected (Date unspecific). If trading_month < 0 then data point of current date minus trading_month is selected (Date specific). If trading_month > 0 then the x-th (x = month) data point is selected (Date unspecific). Default is 0. |

| trading_date (optional) | The trading date. If the trading date is given, then it overrules the trading month argument. No default value. |

| best_match (optional) | Finds best trading data point, if no trading (month/date) argument matches. Valid values are FALSE (= 0) or TRUE (<> 0). Default is FALSE. |

Examples

The QAVMA function uses the Alpha Vantage TIME_SERIES_MONTHLY_ADJUSTED API to return monthly adjusted stock data for the given stock symbol. The latest data point is the prices and volume information for the month (or partial month) that contains the current trading day. All other data points contain monthly stock information from the last trading day of the month (usually the last working day of the month).

| Excel Formula | Result |

|---|---|

| =QAVMA("MSFT") | Returns the recent "adjusted close" stock quote of Microsoft Corporation. |

| =QAVMA("MSFT","close") | Returns the recent "close" stock quote of Microsoft Corporation. |

| =QAVMA("MSFT","high",-2) | Returns the "high" stock quote of Microsoft Corporation from two weeks ago. Hint: Trading date is calculated by subtraction trading month (in months) from the current date. The calculated trading date must be contained in the AV response. |

| =QAVMA("MSFT","open",5) | Returns the 5th "open" stock quote from the Alpha Vantage query result of Microsoft Corporation. |

| =QAVMA("MSFT","volume",,"2020-01-03") | Returns the trading volume of Microsoft Corporation of 2020-01-03. Note: The given date must be contained in the AV response. |

| =QAVMA("MSFT",,,"2020-01-01",TRUE) | Returns the "close" stock quote of Microsoft Corporation of 2019-12-27. Hint: No new year's day stock quote is available, latest available stock quote is then 2019-12-27 (best_match = TRUE). |

Syntax

QAVMA(symbol,[info],[trading_month],[trading_date],[best_match])

| Argument Name | Description |

|---|---|

| symbol (required) | The symbol of the stock. The symbol can be a string, or a cell reference like A2. |

| info (optional) | The stock info to return. Supported values are open, high, low, close, adjusted close, volume and dividend amount (case insensitive). Default is adjusted close. |

| trading_week (optional) | Month/X-th item of the time series. If trading_month = 0 then most recent data point is selected (Date unspecific). If trading_month < 0 then data point of current date minus trading_month is selected (Date specific). If trading_month > 0 then the x-th (x = month) data point is selected (Date unspecific). Default is 0. |

| trading_date (optional) | The trading date. If the trading date is given, then it overrules the trading month argument. No default value. |

| best_match (optional) | Finds best trading data point, if no trading (month/date) argument matches. Valid values are FALSE (= 0) or TRUE (<> 0). Default is FALSE. |

Examples

The QAVMA function is a wrapper for all Alpha Vantage time series APIs (except GLOBAL_QUOTE). The interval argument determines the API that is used.

| Excel Formula | Result |

|---|---|

| =QAVTS("MSFT") | Returns the recent "close" stock quote of Microsoft Corporation from the TIME_SERIES_DAILY API. |

| =QAVTS("MSFT","close") | Returns the recent "close" stock quote of Microsoft Corporation from the TIME_SERIES_DAILY API. |

| =QAVTS("MSFT","high","weekly",-2) | Returns the "high" stock quote of Microsoft Corporation from the TIME_SERIES_WEEKLY API from two weeks ago. |

| =QAVTS("MSFT","open","5min") | Returns the recent "open" stock quote of Microsoft Corporation from the TIME_SERIES_INTRADAY API. |

| =QAVTS("MSFT","volume",,,"2020-01-03",TRUE) | Returns the trading volume of Microsoft Corporation of 2020-01-03 from the TIME_SERIES_DAILY_ADJUSTED API. Note: The given date must be contained in the AV response. |

| =QAVTS("MSFT",,"daily",101,,,"compact",TRUE) | Returns the oldest available "close" stock quote of Microsoft Corporation from the TIME_SERIES_DAILY API. Hint: In output_size compact only 100 data points are available, oldest available stock quote is the one from the 100th data point (best_match = TRUE). |

Syntax

QAVTS(symbol,[info],[interval],[trading_day],[trading_date],[adjusted],[output_size],[best_match])

| Argument Name | Description |

|---|---|

| symbol (required) | The symbol of the stock. The symbol can be a string, or a cell reference like A2. |

| info (optional) | The stock info to return. Supported values are open, high, low, close, adjusted close, volume, dividend amount and split coefficient (case insensitive). Default is close. |

| interval (optional) | Defines the AlphaVantage API to use. Valid values are daily, weekly, monthly, 1min, 5min, 15mn, 30min and 60min (case insensitive). Default is daily. |

| trading_day (optional)* | Day/X-th item of the time series. If trading_day = 0 then most recent data point is selected (Date unspecific). If trading_day < 0 then data point of current date minus trading_day is selected (Date specific). If trading_day > 0 then the x-th (x = day) data point is selected (Date unspecific). Default is 0. |

| trading_date (optional)* | The trading date. If the trading date is given, then it overrules the trading day argument. No default value. |

| adjusted (optional)° | Query adjusted values or not. Valid values are FALSE (= 0) or TRUE (<> 0). Default is FALSE. |

| output_size (optional)^ | The output size of the returned data points. Valid values are compact or full (case insensitive). Default is compact. |

| best_match (optional)* | Finds best trading data point, if no trading (day/date) argument matches. Valid values are FALSE (= 0) or TRUE (<> 0). Default is FALSE. |

* Used for interval daily, weekly, and monthly only.

° Used for interval daily only.

^ Used for interval daily and [1|5|15|30|60]min only.

Examples

The examples shown above can be downloaded here.

-

If you retrieve the FFE formula error

#AV_CALL_LIMIT_REACHED, then you reached the Alpha Vantage API call volume limit (of 5 requests per minute or 500 requests per day for the free service, see also Alpha Vantage FAQs). For this case FFE has theRefresh #AV-Errorsribbon button. This button re-calculates only AVQ functions, that previously returned an #AV_-error.

Buy a premium API key from Alpha Vantage with a higher API call volume for mass requests. Note: FFE cannot provide support for issues related to premium API keys.

-

No Alpha Vantage API Key is set. Set Alpha Vantage API Key via FFE ribbon button

Set API Key. Default key is "demo", which only works with limited symbols (e.g. "MSFT"). -

To many Alpha Vantage requests per minutes or day (FFE formula error

#AV_CALL_LIMIT_REACHED). See also best practices.

All AVQ specific options are available via the ribbon group AVQ in the ribbon tab FFE.

-

Set API KeySets the Alpha Vantage API Key. -

Stop Refresh On ErrorIf enabled, then (re-)calculation stops at the first#AV_CALL_LIMIT_REACHEDerror. -

Refresh #AV-Errors(Re-)Calculates all AVQ user-defined functions which previously returned an FFE formula #AV_-error. -

Help-

Alpha Vantage: HomepageLink to the Alpha Vantage Homepage. -

Alpha Vantage: Term of ServicesLink to the Alpha Vantage Term of Services. -

Alpha Vantage: Get Free API KeyLink to the Alpha Vantage Claim your API Key web page.

-